Rt 6A Florida Form in PDF

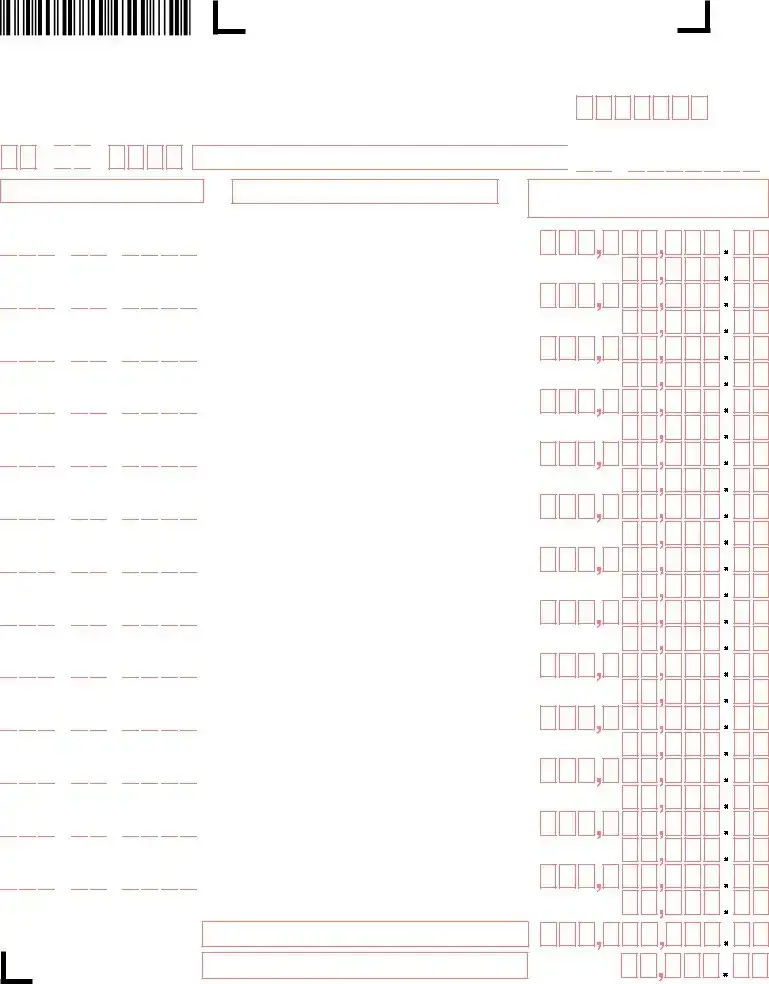

The Rt 6A Florida form serves as the Employer’s Quarterly Report Continuation Sheet, a crucial document for employers in Florida. This form ensures that employers report their tax and wage information quarterly, regardless of employment activity or tax liabilities. Understanding its requirements is essential for compliance with Florida’s tax regulations.

Customize Rt 6A Florida Here

Rt 6A Florida Form in PDF

Customize Rt 6A Florida Here

Customize Rt 6A Florida Here

or

⇩ Rt 6A Florida File

Don’t forget to finish your form

Edit and finish Rt 6A Florida online in just minutes.

/

/

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-