|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-1120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 6 |

NAME |

|

|

|

|

|

FEIN |

|

|

|

|

|

|

TAXABLE YEAR ENDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

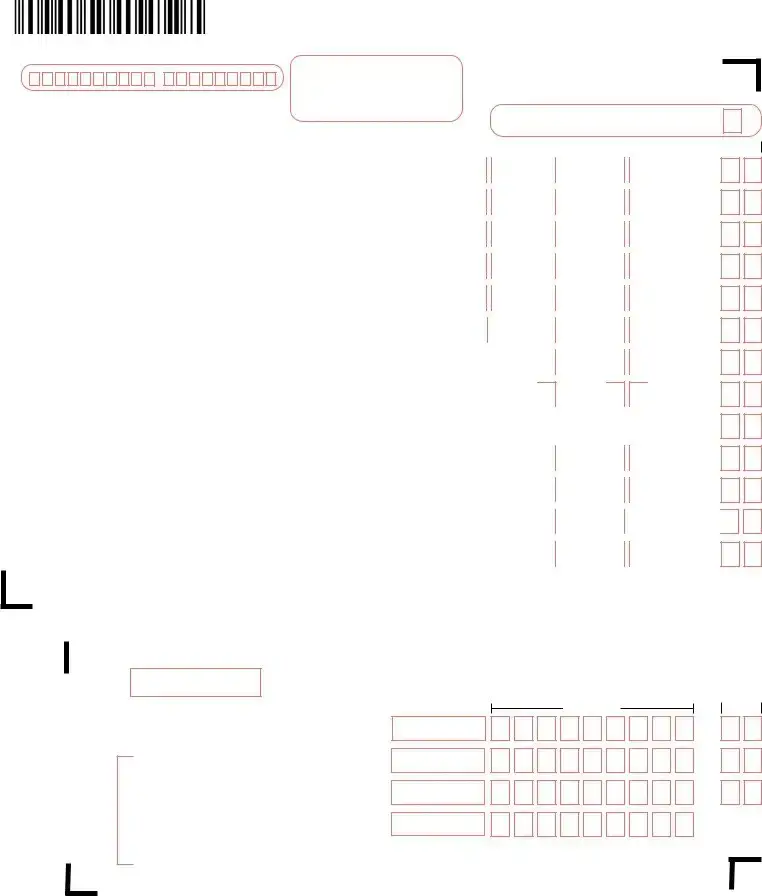

Schedule III — Apportionment of Adjusted Federal Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

III-A For use by taxpayers doing business outside Florida, except those providing insurance or transportation services. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

(c) |

|

|

|

|

(d) |

|

|

|

(e) |

|

|

|

WITHIN FLORIDA |

|

TOTAL EVERYWHERE |

Col. (a) ÷ Col. (b) |

|

|

|

|

Weight |

|

|

|

Weighted Factors |

|

|

|

(Numerator) |

|

(Denominator) |

|

|

Rounded to Six Decimal |

|

If any factor in Column (b) is zero, |

|

Rounded to Six Decimal |

|

|

|

|

|

|

|

|

|

Places |

|

|

see note on Page 9 of the instructions. |

|

Places |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Property (Schedule III-B below) |

|

|

|

|

|

|

|

|

|

|

|

X 25% or ______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Payroll |

|

|

|

|

|

|

|

|

|

|

|

X 25% or ______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Sales (Schedule III-C below) |

|

|

|

|

|

|

|

|

|

|

|

X 50% or ______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Apportionment fraction (Sum of Lines 1, 2, and 3, Column [e]). Enter here and on Schedule IV, Line 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III-B For use in computing average value of property (use original cost). |

|

|

|

WITHIN FLORIDA |

|

|

|

|

|

|

TOTAL EVERYWHERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Beginning of year |

|

b. End of year |

|

c. Beginning of year |

|

d. End of year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Inventories of raw material, work in process, finished |

goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Buildings and other depreciable assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Land owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Other tangible and intangible (financial org. only) assets (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Total (Lines 1 through 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Average value of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Add Line 5, Columns (a) and (b) and divide by 2 (for within Florida)........... 6a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Add Line 5, Columns (c) and (d) and divide by 2 (for total Everywhere) |

|

|

|

|

|

|

|

|

6b. |

|

|

|

|

|

|

|

7. |

Rented property (8 times net annual rent) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Rented property in Florida |

|

|

7a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Rented property Everywhere |

|

|

|

|

|

|

|

|

|

|

7b. |

|

|

|

|

|

|

|

8. |

Total (Lines 6 and 7). Enter on Line 1, Schedule III-A, Columns (a) and (b). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Enter Lines 6a. plus 7a. and also enter on Schedule III-A, Line 1, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column (a) for total average property in Florida |

|

|

8a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Enter Lines 6b. plus 7b. and also enter on Schedule III-A, Line 1, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column (b) for total average property Everywhere |

|

|

|

|

|

|

|

|

|

|

8b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III-C Sales Factor |

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

(b) |

|

|

|

|

|

|

|

|

|

|

TOTAL WITHIN FLORIDA |

|

|

TOTAL EVERYWHERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Numerator) |

|

|

|

(Denominator) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Sales (gross receipts) |

|

|

|

|

|

|

|

|

|

|

N/A |

|

|

|

|

|

|

2. |

Sales delivered or shipped to Florida purchasers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Other gross receipts (rents, royalties, interest, etc. when applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

TOTAL SALES (Enter on Schedule III-A, Line 3, Columns [a] and [b]) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III-D Special Apportionment Fractions (see instructions) |

|

|

(a) WITHIN FLORIDA |

|

|

(b) TOTAL EVERYWHERE |

|

(c) FLORIDA Fraction ([a] ÷ [b]) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rounded to Six Decimal Places |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Insurance companies (attach copy of Schedule T–Annual Report) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Transportation services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

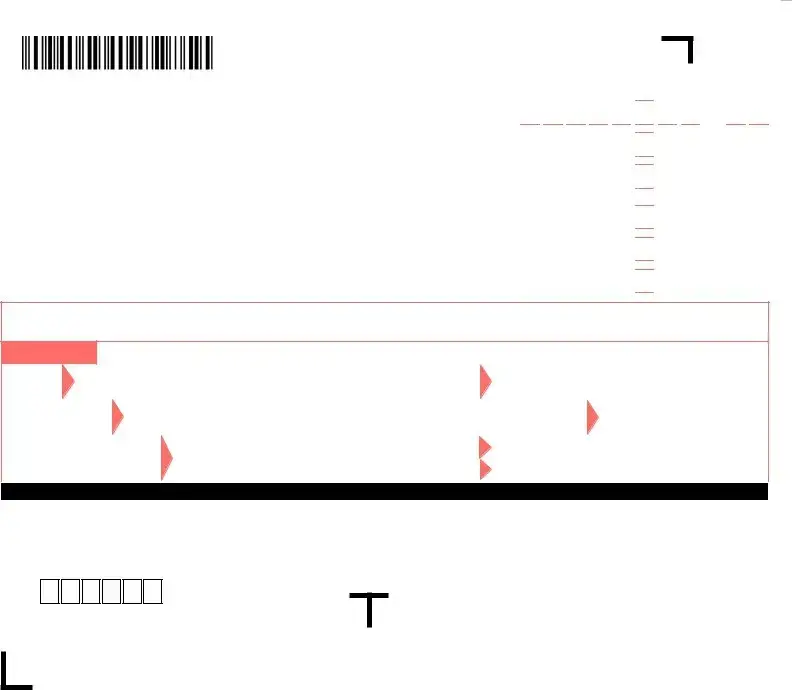

Schedule IV — Computation of Florida Portion of Adjusted Federal Income |

|

|

|

|

|

|

|

|

|

|

1. |

Apportionable adjusted federal income from Page 1, Line 6 |

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Florida apportionment fraction (Schedule III-A, Line 4) |

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Tentative apportioned adjusted federal income (multiply Line 1 by Line 2) |

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Net operating loss carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Net capital loss carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Excess charitable contribution carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Employee benefit plan contribution carryover apportioned to Florida (attach schedule; see instructions) |

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Total carryovers apportioned to Florida (add Lines 4 through 7) |

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Adjusted federal income apportioned to Florida (Line 3 less Line 8; see instructions) |

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.