Florida Dr 157 Form in PDF

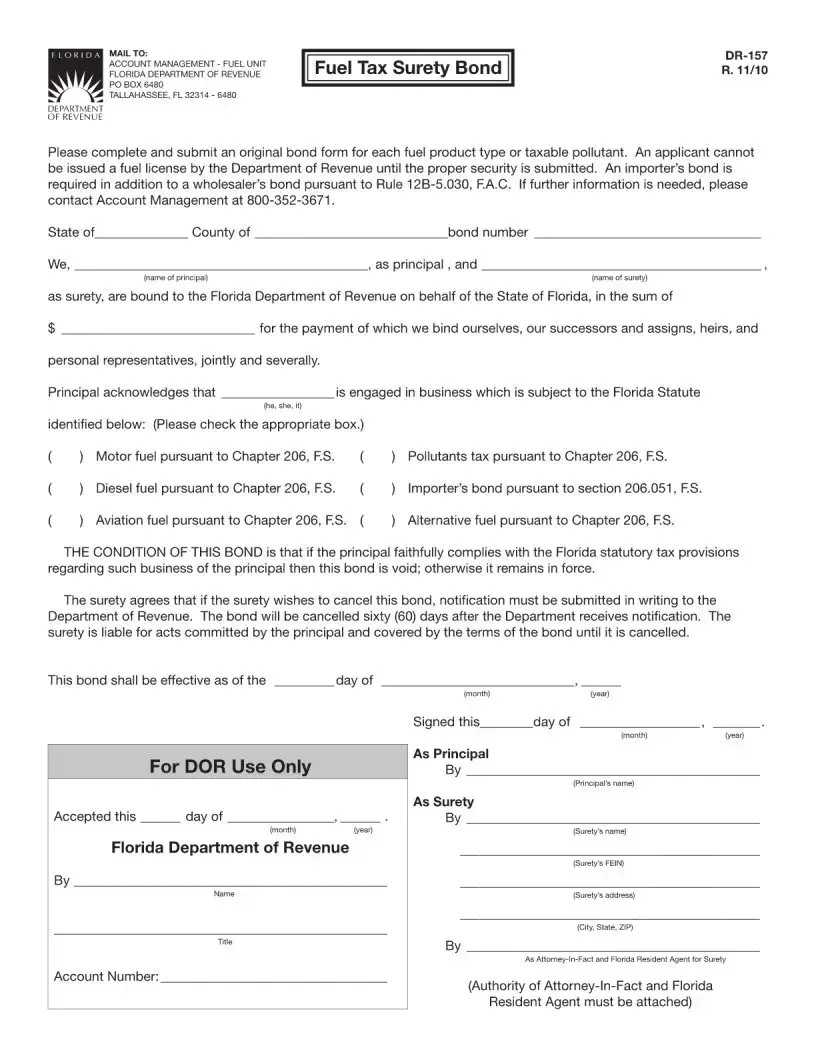

The Florida DR 157 form is a crucial document used for establishing a Fuel Tax Surety Bond with the Florida Department of Revenue. This bond ensures compliance with state tax regulations related to various fuel products and pollutants. Completing this form is essential for any business seeking a fuel license, as it serves as a guarantee of payment for taxes owed to the state.

Customize Florida Dr 157 Here

Florida Dr 157 Form in PDF

Customize Florida Dr 157 Here

Customize Florida Dr 157 Here

or

⇩ Florida Dr 157 File

Don’t forget to finish your form

Edit and finish Florida Dr 157 online in just minutes.